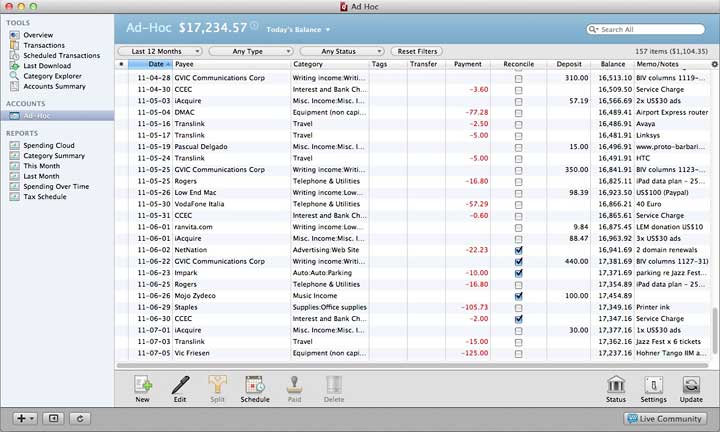

Since I use my Quicken primarily to enter personal checks and print them on a laser printer, it was useless. So I downloaded the 30 day trial for IBank and converted my Quicken 2006 to QIF and installed. The data did convert for the most part flawlessly, but when I went to enter a check, I was in for a big surprise. Aug 12, 2020 Banktivity (was iBank) is a new standard for Mac money management. With its intuitive user interface and a full set of money-management features, Banktivity is the most complete software available for Mac personal finance.

I switched to a Mac in early 2005 and although I don’t see myself ever willingly going back to Windows at home (I use it at work), the one area that makes me wish I was on a PC is personal finance software. I’ve been a Quicken user since 2000 and have enjoyed the benefits of easily tracking my spending, budgeting, online bill pay and cash flow forecasting for almost all of my adult life. I can still remember pondering the switch to Mac and thinking, “oh great, they have Quicken for Mac.” But that was the last time I thought of a product from Intuit in a positive light. Converting from Quicken for PC to Mac was one of the most difficult software migrations I’ve ever done — and I do them for a living. I spent countless hours on the phone with support trying to figure out why my registrars didn’t balance when I imported my qif files — no, Intuit doesn’t support a direct import, but rather you export everything and import it back in. In the end I made the transition and missed the superior PC version of Quicken, holding my breath as Intuit released paid upgrades to its Mac product, only to realize none of my beefs were addressed.

But hey, at least it worked and it had many of the same features I had in the PC world, that was until Lion came along. Faced with the choice to upgrade to Quicken Essentials or to not upgrade to Lion, I bit the bullet and hoped for the best. That hope was unfounded as I lost access to one of my favorite features, online bill pay. For the past 10 years I’ve entered a transaction into Quicken and had it paid by my bank automatically, but not anymore. Now I have to enter the transaction into my bank’s website and then enter it again into Quicken — if I wait for the transaction to clear, which will enter it automatically, I don’t have the ability to forecast my cash flow. That is bad enough, but the budget tool in Quicken Essentials does not work, I won’t go over the details here, but the issues are well documented in the Intuit community forums.

And so last month I decided to get serious about budgeting and while a spreadsheet does a pretty decent job at a high level, tracking my day-to-day spending against the budget on a spreadsheet is anything but workable. At first I tried HomeBudget for the iPhone and while it was ok, I found it tedious to enter each transaction manually since it doesn’t link to my bank account. Then there was the Mint upgrade this month, which added budget features, so I figured now was a time to try it again. Mint is actually pretty good at keeping tracking of spending with a great iPhone app and website. I can quickly open it on the go and categorize my spending and see how I’m doing vs my goals in that category. I haven’t tried it a whole month yet, but I’m hopeful it’ll fit this specific need. The problem is, it only fits this one need, and not all my needs as it doesn’t do cash flow forecasting, at all, or bill pay. I can’t even work on a budget until the month begins — typically I like to get it worked out at least a few days in advanced.

Ibank Software

So here I am over two years after Quicken Essentials was released realizing that Intuit is never going to fix it, never going to add online bill pay and never going to add an iPhone app that syncs automatically. So instead I’m using four applications to do what I used to do with a single app (bank site for bill pay, Quicken Essentials for cash flow forecasting and reconciliation, Mint to track day-to-day spending, and Google Docs for my monthly budget).

Convert From Ibank To Quicken For Mac Online

I switched to a Mac in early 2005 and although I don’t see myself ever willingly going back to Windows at home (I use it at work), the one area that makes me wish I was on a PC is personal finance software. I’ve been a Quicken user since 2000 and have enjoyed the benefits of easily tracking my spending, budgeting, online bill pay and cash flow forecasting for almost all of my adult life. I can still remember pondering the switch to Mac and thinking, “oh great, they have Quicken for Mac.” But that was the last time I thought of a product from Intuit in a positive light. Converting from Quicken for PC to Mac was one of the most difficult software migrations I’ve ever done — and I do them for a living. I spent countless hours on the phone with support trying to figure out why my registrars didn’t balance when I imported my qif files — no, Intuit doesn’t support a direct import, but rather you export everything and import it back in. In the end I made the transition and missed the superior PC version of Quicken, holding my breath as Intuit released paid upgrades to its Mac product, only to realize none of my beefs were addressed.

But hey, at least it worked and it had many of the same features I had in the PC world, that was until Lion came along. Faced with the choice to upgrade to Quicken Essentials or to not upgrade to Lion, I bit the bullet and hoped for the best. That hope was unfounded as I lost access to one of my favorite features, online bill pay. For the past 10 years I’ve entered a transaction into Quicken and had it paid by my bank automatically, but not anymore. Now I have to enter the transaction into my bank’s website and then enter it again into Quicken — if I wait for the transaction to clear, which will enter it automatically, I don’t have the ability to forecast my cash flow. That is bad enough, but the budget tool in Quicken Essentials does not work, I won’t go over the details here, but the issues are well documented in the Intuit community forums.

And so last month I decided to get serious about budgeting and while a spreadsheet does a pretty decent job at a high level, tracking my day-to-day spending against the budget on a spreadsheet is anything but workable. At first I tried HomeBudget for the iPhone and while it was ok, I found it tedious to enter each transaction manually since it doesn’t link to my bank account. Then there was the Mint upgrade this month, which added budget features, so I figured now was a time to try it again. Mint is actually pretty good at keeping tracking of spending with a great iPhone app and website. I can quickly open it on the go and categorize my spending and see how I’m doing vs my goals in that category. I haven’t tried it a whole month yet, but I’m hopeful it’ll fit this specific need. The problem is, it only fits this one need, and not all my needs as it doesn’t do cash flow forecasting, at all, or bill pay. I can’t even work on a budget until the month begins — typically I like to get it worked out at least a few days in advanced.

So here I am over two years after Quicken Essentials was released realizing that Intuit is never going to fix it, never going to add online bill pay and never going to add an iPhone app that syncs automatically. So instead I’m using four applications to do what I used to do with a single app (bank site for bill pay, Quicken Essentials for cash flow forecasting and reconciliation, Mint to track day-to-day spending, and Google Docs for my monthly budget).