The MAC Fibo Indicator for MT4. The MAC Fibo Indicator for MT4 is an indicator that is built for the everyday trader who uses the Meta Trader 4 charting platform. It is based on the Moving Average indicator and the Fibonacci principle. Fibonacci EA: This EA is based on modified Fibonacci strategy. It works on all timeframes. The EA uses data from two days ago to open position (for example: if you - English. The Fibonacci sequence is a sequence consisting of the sum of the previous two numbers, such as “1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89”. The EMA of this indicator applies this Fibonacci sequence to the calculation period. How to use: Try using it like a normal crossover system. For example, if the first moving average line (short-term.

The Fibonacci MTF Channel Forex Strategy is based on the traditional usage of pivot points and support & resistance levels.

The main purpose of designing this system is to alert traders of likely trend reversals following a retracement in price.

The chances of a trend reversal reduces during low volatility trading sessions.

However, during higher volatility sessions, larger trailing loss should be set in a bid to safeguard traders from range bound trading.

Once you carefully look at the dynamic lines of the Channels Fibo MTF custom indicator in real time, then you’ll realize the strength of this system.

Chart Setup

MetaTrader 4 Indicators: channelsfibo-mtf.ex4 (Default Setting), stepma-signale.ex4 (Default Setting), stealth-oscillator.ex4 (Inputs Variable Modified; SMAPeriod=36, LSMAPeriod=36)

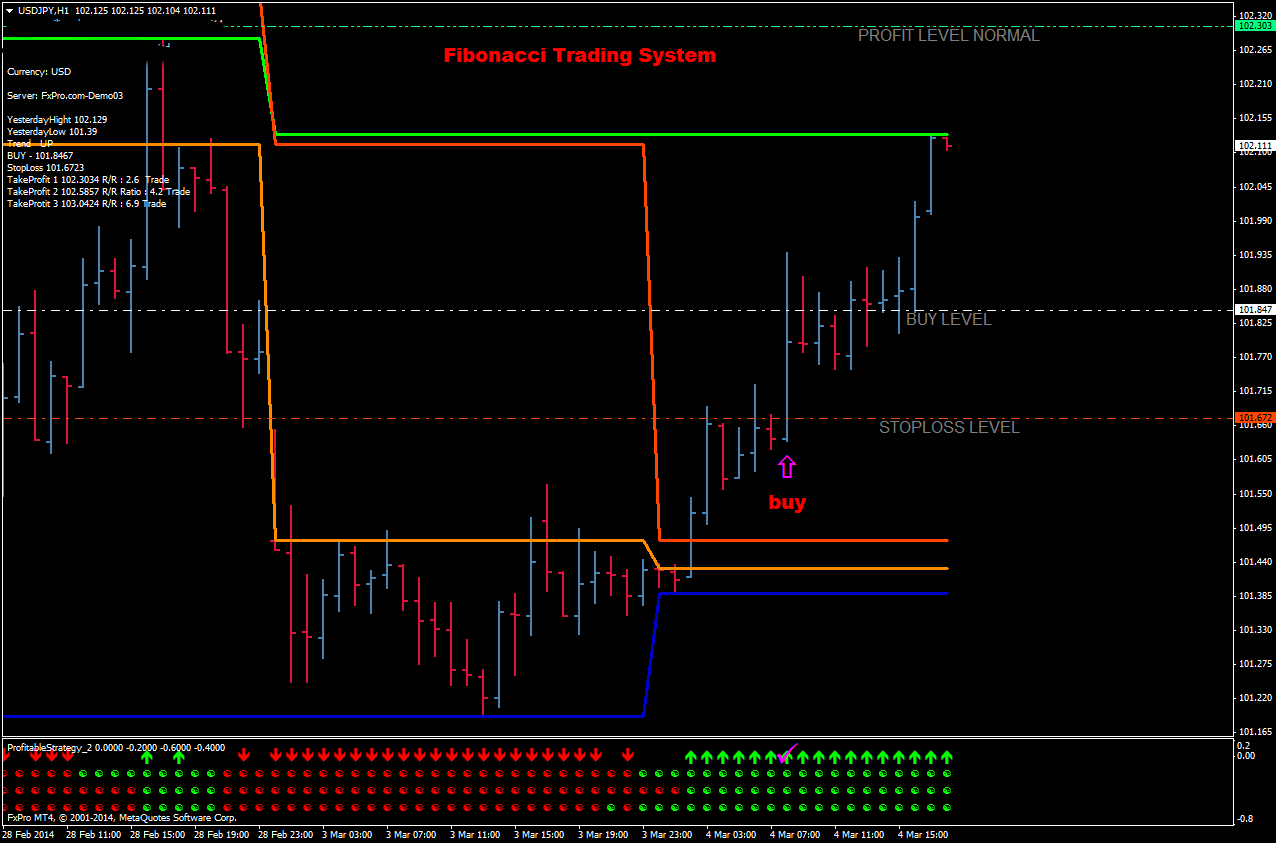

Fibonacci Trading System Metatrader For Mac Windows 10

Preferred Time Frame (s): 1-Minute, 5-Minute, 15-Minutes, 30-Minutes, 1-Hour, 4-Hours, 1-Day, 1-Week

Recommended Trading Sessions: Any

Currency Pairs: Any pair

Download

Buy Trade Example

Fig. 1.0

Strategy

Metatrader For Macintosh

Long Entry Rules

Enter a bullish trade if the following indicator or chart pattern gets put on display:

- If price is in an uptrend and it bounces off the 61.80% Fibonacci level of the channelsfibo-mtf Metatrader 4 indicator on “Point A” followed by a retracement on the 23.60% Fibonacci level (on “Point B” ) as indicated on Fig. 1.0, price is said to be making an upward push, therefore a buy alert is said to be looming.

- If the dodger blue upward pointing arrow of the stepma-signale indicator followed by its lime green line align somewhat below the candlesticks as depicted on Fig. 1.0, the overall market sentiment is said to be bullish, as such a buy alert will do.

- If the lime horizontal bar of the stealth-oscillator indicator gets displayed within its window as seen on Fig. 1.0, it is pointing to bullish price pressures, hence a buy alert will suffice.

Stop Loss for Buy Entry: Place stop loss 3 pips below support.

Exit Strategy/Take Profit for Buy Entry

Exit or take profit from all trades if the following rules or conditions takes precedence:

- If price closes below the 23.60% Fibonacci level on the channelsfibo-mtf indicator during a bullish signal, it is an indication of weaning bulls power, hence an exit or take profit is rightly advised.

- If the stepma-signale custom indicator displays a magenta downward pointing arrow during the course of a bullish signal, it is pointing at bulls’ exhaustion in the market, therefore an exit or take profit is imminent.

- If the stealth-oscillator custom indicator pops up a red horizontal line while a bullish trend is running (refer to Fig. 1.0), it is signaling a likely end to the current trend, hence an exit or take profit is duly recommended.

Sell Entry Rules

Go short if the following setups gets displayed rightly on the activity chart:

- If price is in a downtrend and it bounces off the 38.20% Fibonacci level of the channelsfibo-mtf indicator on “Point A” followed by a retracement on the 23.60% Fibonacci level (on “Point B” ) as exemplified on Fig. 1.1, price is said to be driving lower, therefore a sell alert is said to be on the horizon.

- If the magenta downward pointing arrow of the stepma-signale indicator along with its orange line stay fairly above the price bars as illustrated on Fig. 1.1, the general market sentiment is said to be bearish, as such a sell alert will do.

- If the red horizontal bar of the stealth-oscillator indicator gets displayed within its window as seen on Fig. 1.1, it is signaling bearish price pressures, hence a sell alert will be sufficient.

Stop Loss for Sell Entry: Place stop loss 3 pips above resistance.

Exit Strategy/Take Profit for Sell Entry

Exit or take profit if the following takes center stage:

- If price closes above the 23.60% Fibonacci level on the channelsfibo-mtf indicator during a bearish trend, it is an indication of halting bears power, hence an exit or take profit is duly advised.

- If the stepma-signale custom indicator displays a dodger blue upward pointing arrow during the course of a bearish signal (check Fig 1.1), bears are said to closing their positions increasingly, therefore an exit or take profit is impending.

- If the stealth-oscillator custom indicator pops up a lime horizontal line during a bearish trend, it is an indication that the current trend is weaning, hence an exit or take profit is duly advised.

Sell Trade Example

Fig. 1.1

Free Download

About The Trading Indicators

The channelsfibo-mtf is a custom indicator that identifies key levels of support and resistance using the Fibonacci levels.

The stepma-signale is a Metatrader 4 indicator that is built based on the moving averages and does well in gauging trends.

The stealth-oscillator is a custom forex indicator that combines the Simple Moving Average (SMA) and Least Squares Moving Average (LSMA).

The resultant indicator is an oscillator that is displayed within a separate window.